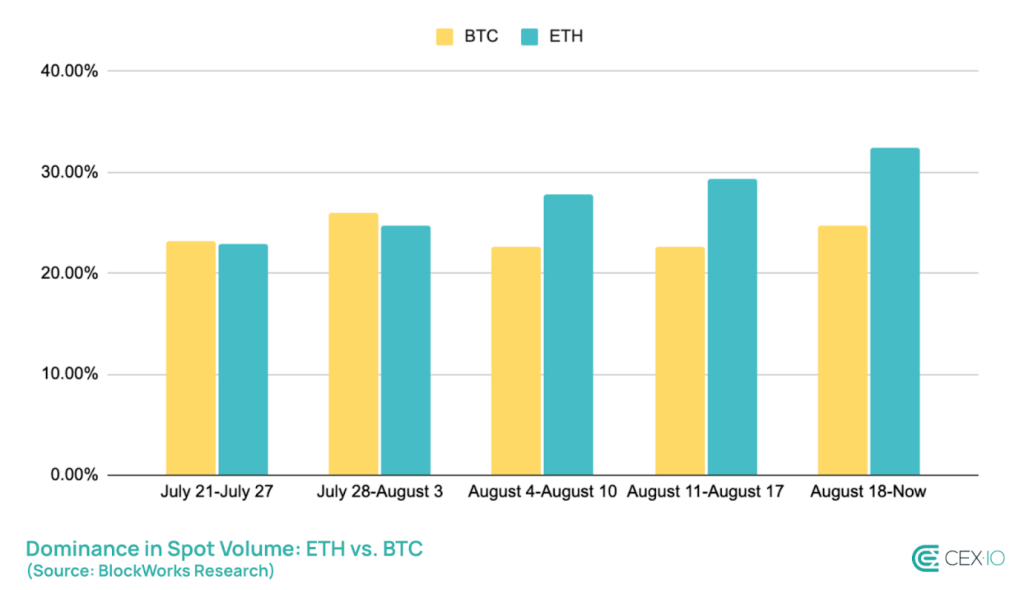

Ethereum simply outtraded Bitcoin in spot quantity for the primary time since 2017. That’s an enormous second that reveals how investor sentiment and institutional curiosity are actually altering issues up.

Ethereum hit $480 billion in spot buying and selling on central exchanges in August 2025, whereas Bitcoin lagged at $401 billion. These aren’t simply numbers. They sign a significant shift in how individuals view these two crypto giants.

For those who’re a Bitcoin investor (particularly in locations like South Asia or Australia) this transformation means it’s time to concentrate to new market dynamics and capital flows. Get able to rethink your methods because the panorama evolves!

A Fast Look Again: Bitcoin’s Reign

Bitcoin has dominated buying and selling quantity since its creation. The final time Ethereum got here shut was again in 2017 in the course of the ICO and DeFi increase. Since then, Bitcoin has solidified its place as “digital gold”.

However the market isn’t static. It’s all the time evolving. Bitcoin’s community buying and selling quantity is now at its lowest since mid-2019, whereas Ethereum has been on the rise. So, what was the massive turning level? Ethereum’s transfer from proof-of-work to proof-of-stake in 2022. This step was in a position to enhance confidence in its long-term potential.

What’s Driving Ethereum’s Surge?

Now you could be questioning what’s behind Ethereum’s latest buying and selling quantity explosion? Listed here are the important thing drivers of the ETH climb. This contains the Ethereum value AUD bump.

Institutional gamers are shifting gears. Corporations like SharpLink Gaming and BitMine Immersion have made enormous Ether purchases this yr. This alerts a transfer away from Bitcoin-heavy portfolios. For instance, SharpLink launched a $1.5 billion Ether shopping for program, and BitMine picked up a staggering 373,110 ETH in mid-August alone.

U.S. spot Ethereum ETFs are making it simpler for establishments to spend money on ETH. Ethereum ETFs noticed $3.87 billion in inflows whereas Bitcoin ETFs skilled outflows of $751 million in August 2025. This reveals that establishments are more and more betting on Ethereum’s future.

About 27.5% of Ethereum provide is presently staked and creates provide constraints that assist stabilize costs and drive buying and selling curiosity. This staking course of presents yields that Bitcoin merely can’t match and makes it a beautiful possibility for buyers on the lookout for earnings.

Latest Market Dynamics Resulting in What’s Subsequent.

The technical indicators are backing the momentum of Ethereum and its rising enchantment to each institutional and retail buyers is tough to disregard.

| Metric | Ethereum | Bitcoin |

| August 2025 Spot Quantity. | $480B | $401B |

| YTD Value Progress. | 30% | 20% |

| All Time Excessive. | $4 950 | $124 171 |

| Present Value (Oct 2025). | $3 933 | $90 000 |

The ETH/BTC ratio has been on a gentle climb and shifting up from historic lows to hit 0.05854 by Could 2025. Some analysts suppose it might even attain 0.1 within the coming months, which reveals Ethereum’s potential to outperform.

Ethereum’s futures buying and selling quantity has additionally taken off, leaping from 42% of Bitcoin’s in October 2024 to an enormous 98% now. This shift suggests extra subtle merchants are diving into Ethereum and bringing in institutional-level liquidity and higher value discovery.

Implications for Bitcoin Traders

This shift in quantity has some key takeaways for each present and future Bitcoin buyers:

- Look in in direction of Diversifying your Portfolio

The buying and selling information hints that institutional buyers are beginning to lean towards Ethereum. Whereas Bitcoin continues to be the go-to for macro hedging and long-term worth, Ethereum presents a unique kind of demand pushed by its utility.

The excessive Ethereum buying and selling volumes normally sign the beginning of an altcoin season. Bitcoin holders ought to control these shifts as they could level to broader market actions.

Ethereum’s ETF launches are a giant deal that reveals regulatory acceptance of proof-of-stake cryptos. This lowers among the dangers and encourages extra institutional buyers to leap in. This might profit your complete crypto market.

What this all signifies that Ethereum’s rising momentum is price watching- irrespective of should you’re a Bitcoin diehard or an all-around crypto fanatic.

Value Projections and Market Outlook

Let’s discuss the place crypto costs could be headed with all the thrill round establishments getting concerned. Listed here are a couple of eventualities for each Bitcoin and Ethereum:

Ethereum Value AUD targets

- Finish of 2025: We might see it round $4,200-$4,600.

- 2026: Is perhaps a little bit of a cool-down, probably $1,800-$3,160.

- 2027-2030: We might be $9,000-$32,000 if establishments hold leaping in!

Issues to Maintain an Eye On:

- How a lot cash is flowing into crypto ETFs from massive gamers?

- How many individuals are staking Ethereum and how much returns they’re getting.

- How Bitcoin’s community is rising. Particularly the Lightning Community.

- Any new guidelines that change how cryptocurrencies are categorized.

The Australian greenback value of Ethereum is actually tied to how the worldwide market feels and if extra massive firms undertake it. For those who’re an Aussie investor, you would possibly need to take into consideration foreign money hedging.

Future Predictions and Skilled Ideas for Crypto Traders

Right here’s one thing to consider should you’re a Bitcoin investor. Diversify! Splitting investments between Bitcoin and Ethereum can scale back danger since they’re not as tied as earlier than.

Additionally, Ethereum’s been on a roll as 50% of final month’s buying and selling days had been “inexperienced.” A dollar-cost averaging technique could be good, particularly with establishments shopping for in.

And bear in mind to suppose long-term. Bitcoin is stable as digital gold, however Ethereum’s usability and staking make it a rising star price contemplating.

What’s Subsequent? Will Ethereum Keep on Prime or Is This Only a Part?

Ethereum topping buying and selling quantity isn’t simply luck. It alerts a giant shift within the crypto world. Establishments are leaping in, staking is booming, and clearer guidelines are making it a stable guess.

However don’t overlook Bitcoin! Its shortage and confirmed safety nonetheless make it a rock-solid selection when issues get bumpy. The true query is: Can Ethereum hold this lead by way of all market situations?

Consultants like Michael Novogratz even predict the opportunity of an Ethereum provide shock. If extra firms purchase crypto and staking demand grows, count on sustained shopping for stress. This implies the Ethereum quantity will have a tendency to stay excessive.

This milestone means buyers ought to change issues up a bit past simply Bitcoin because the market evolves. Watch intently. This might be a everlasting change that you may capitalize on as one of many early adopters!